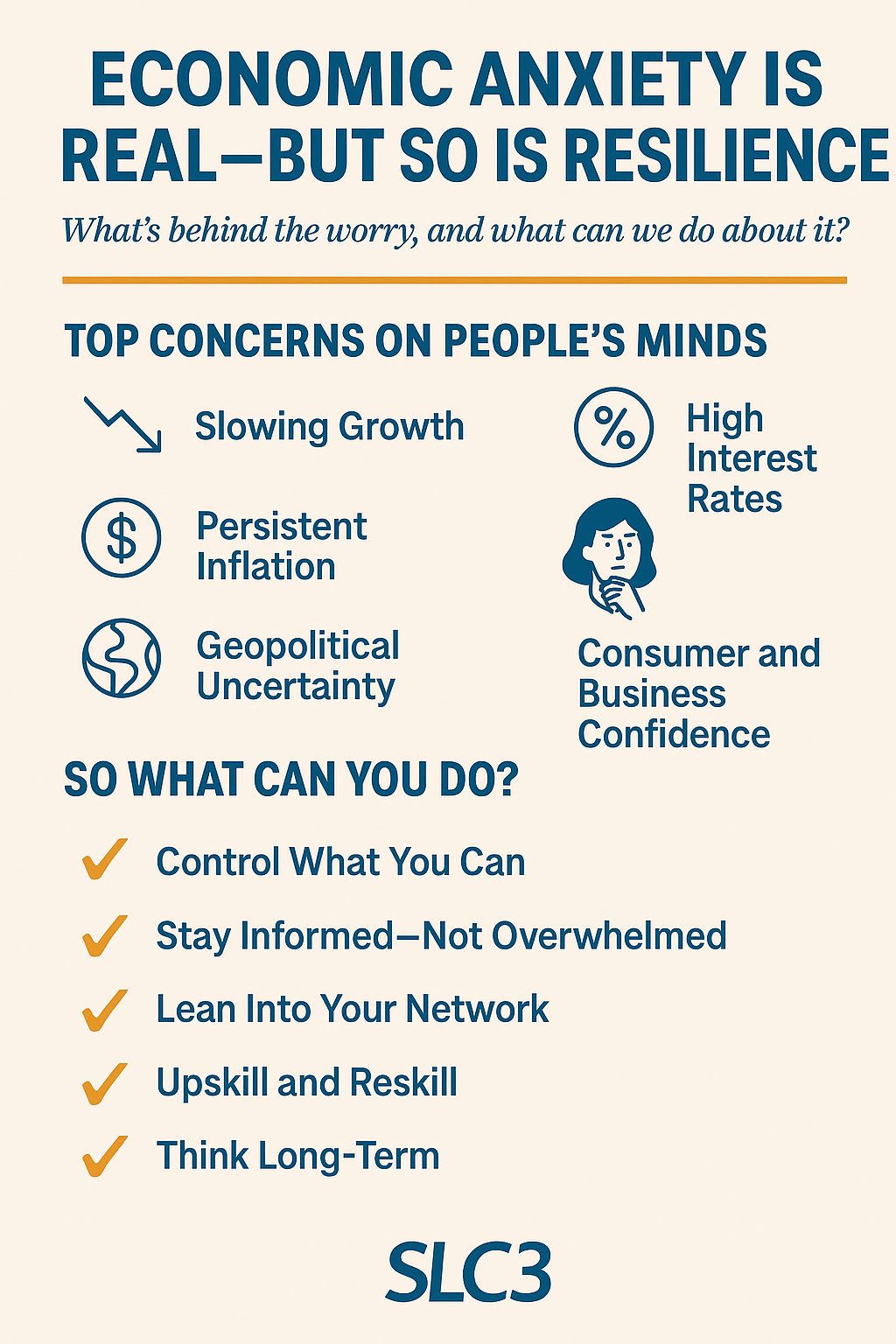

What’s behind the worry, and what can we do about it?

You’ve heard the conversations in the office, on job sites, and maybe at your own dinner table:

“Is a recession coming?”

“Will inflation ever come down?”

“How will this economy affect my job… my business… my retirement?”

We get it. The headlines are loud, the forecasts are fuzzy, and the uncertainty can feel overwhelming. Here’s a breakdown of the most common economic concerns we’re hearing—and more importantly, some level-headed ways to manage them.

Top Concerns on People’s Minds

1. Slowing Growth

Economic projections for 2025 suggest slower growth—possibly under 2%. That can mean reduced demand, smaller budgets, and tighter competition for projects.

2. Persistent Inflation

Even as inflation starts to cool, prices remain higher than they were just a few years ago. It’s not just gas and groceries—it’s also insurance, equipment, and materials.

3. High Interest Rates

Borrowing is still expensive. Whether you’re buying a house, expanding a business, or managing cash flow, higher rates are making decisions tougher.

4. Geopolitical Uncertainty

From global conflicts to supply chain disruptions, world events are creating ripple effects in trade, investment, and consumer confidence.

5. Consumer and Business Confidence

People are hesitant to spend, and businesses are holding off on major investments. That caution can slow momentum in industries like construction and real estate.

So What Can You Do?

Here’s how to stay calm, focused, and in control—even when the headlines aren’t.

1. Control What You Can

You can’t change the Federal Reserve’s next move, but you can monitor your own spending, budgeting, and business planning. Look at your costs. Reevaluate priorities. Get lean, not reactive.

2. Stay Informed—Not Overwhelmed

Don’t let a single scary headline drive your decisions. Trust reputable sources. Focus on the full picture, not just the loudest voice on social media.

3. Lean Into Your Network

This is where associations like SLC3 shine. You don’t have to navigate uncertainty alone. Tap into peer conversations, attend events, and learn from others who are adapting in real time.

4. Upskill and Reskill

Whether it’s leadership training, technology adoption, or cross-functional knowledge—sharpening your team’s skillset is one of the smartest investments in any economy.

5. Think Long-Term

This won’t last forever. Recessions, slowdowns, and recoveries are all part of the economic cycle. The companies and professionals who plan now will be the ones ahead when things bounce back.

✨ Final Thought: Be Proactive, Not Panicked

Economic anxiety is normal—but paralysis doesn’t help. Preparation, education, and strategic thinking will always outperform worry.

As the old saying goes: “It’s not about predicting the storm, it’s about learning to sail the ship.”

You’ve got this—and SLC3 is here to help you stay steady, informed, and connected no matter what the economy throws our way.