The Midwest’s nonresidential construction market is on track for a historic peak in 2025, with total starts projected to reach $145.5 billion before moderating to $126.9 billion in 2026 and stabilizing near $131.5 billion in 2027. This isn’t a downturn—it’s a market normalization, reflecting a shift in sector strength rather than an overall slowdown.

Civil construction will lead the way, fueled by major federal and state infrastructure investment and expected to deliver more than $65 billion in 2025, nearly half of all nonresidential activity. That momentum will continue through 2027, providing a reliable foundation for contractors focused on transportation, utilities, and energy systems.

Meanwhile, education remains steady, industrial work shifts toward modernization, and both commercial and government building are expected to contract after 2025. For contractors and suppliers, the opportunity lies in pivoting toward resilient sectors—civil, education, and healthcare—while using data and forecasting tools to anticipate changing demand.

In short, 2025 marks both the culmination of a growth cycle and the beginning of a new baseline for Midwest construction. Firms that plan ahead, adapt to shifting sector dynamics, and leverage strong market intelligence will be best positioned to thrive as the region realigns and stabilizes over the next three years.

For article researched: ConstructConnect News

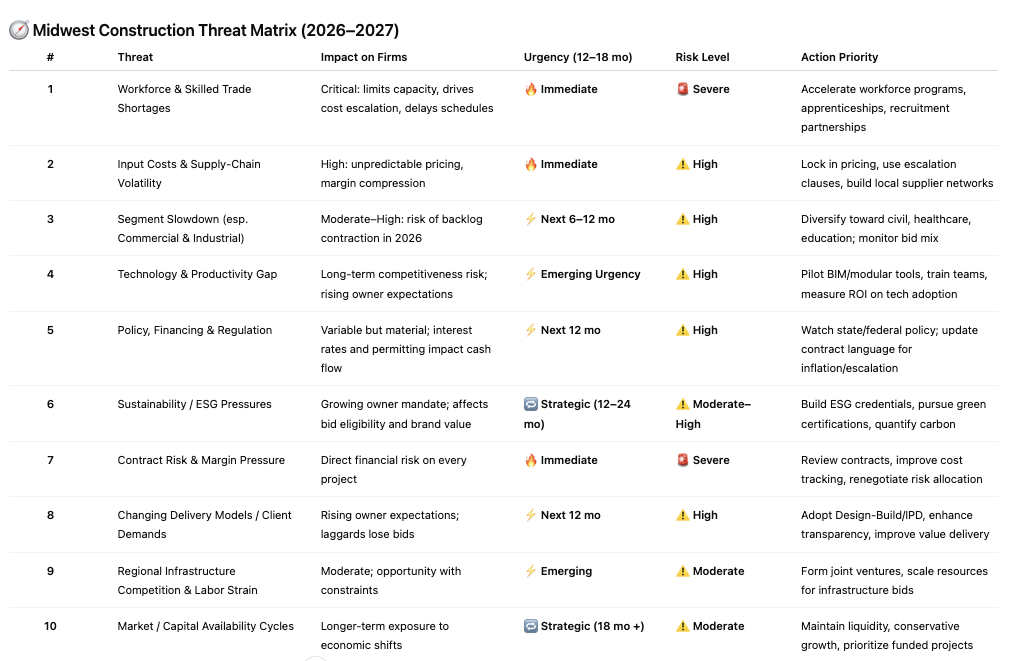

🧭 Midwest Construction Threat Matrix (2026–2027)

| # | Threat | Impact on Firms | Urgency (12–18 mo) | Risk Level | Action Priority |

| 1 | Workforce & Skilled Trade Shortages | Critical: limits capacity, drives cost escalation, delays schedules | 🔥 Immediate | 🚨 Severe | Accelerate workforce programs, apprenticeships, recruitment partnerships |

| 2 | Input Costs & Supply-Chain Volatility | High: unpredictable pricing, margin compression | 🔥 Immediate | ⚠️ High | Lock in pricing, use escalation clauses, build local supplier networks |

| 3 | Segment Slowdown (esp. Commercial & Industrial) | Moderate–High: risk of backlog contraction in 2026 | ⚡ Next 6–12 mo | ⚠️ High | Diversify toward civil, healthcare, education; monitor bid mix |

| 4 | Technology & Productivity Gap | Long-term competitiveness risk; rising owner expectations | ⚡ Emerging Urgency | ⚠️ High | Pilot BIM/modular tools, train teams, measure ROI on tech adoption |

| 5 | Policy, Financing & Regulation | Variable but material; interest rates and permitting impact cash flow | ⚡ Next 12 mo | ⚠️ High | Watch state/federal policy; update contract language for inflation/escalation |

| 6 | Sustainability / ESG Pressures | Growing owner mandate; affects bid eligibility and brand value | 🔁 Strategic (12–24 mo) | ⚠️ Moderate–High | Build ESG credentials, pursue green certifications, quantify carbon |

| 7 | Contract Risk & Margin Pressure | Direct financial risk on every project | 🔥 Immediate | 🚨 Severe | Review contracts, improve cost tracking, renegotiate risk allocation |

| 8 | Changing Delivery Models / Client Demands | Rising owner expectations; laggards lose bids | ⚡ Next 12 mo | ⚠️ High | Adopt Design-Build/IPD, enhance transparency, improve value delivery |

| 9 | Regional Infrastructure Competition & Labor Strain | Moderate; opportunity with constraints | ⚡ Emerging | ⚠️ Moderate | Form joint ventures, scale resources for infrastructure bids |

| 10 | Market / Capital Availability Cycles | Longer-term exposure to economic shifts | 🔁 Strategic (18 mo +) | ⚠️ Moderate | Maintain liquidity, conservative growth, prioritize funded projects |

🔍 Quick Insights

Top 3 Immediate Priorities (Act Now)

- Workforce shortages — Expand hiring pipelines, retention incentives, and partnerships.

- Margin protection — Revisit contracts, cost tracking, and risk allocation.

- Material costs/supply chain — Build resilience through supplier diversification and early procurement.

Mid-Term Focus (6–12 months)

- Embrace digital tools and alternative delivery to offset productivity and labor pressures.

- Watch market shifts: re-target civil, education, healthcare where funding and demand stay strongest.

Strategic (12–24 months)

- Strengthen ESG capabilities and sustainable design expertise.

- Prepare financially for normalized (but stable) market conditions post-2026.

How Members Can Use This

- Leadership Teams: Prioritize investments and training using top-row threats.

- Estimating/Project Controls: Apply contract risk mitigation steps immediately.

- HR & Workforce Development: Align recruitment and retention to the “severe” risk tier.

- Business Development: Focus on resilient segments (civil, education, healthcare).